The March 2025 consensus forecasts reflect a cautious but improving economic outlook for Australia. While inflation and interest rate projections have been revised downward for the short-term, the medium-term outlook suggests stabilisation and gradual recovery. However, weaker growth forecasts and external risks, including U.S. tariffs, highlight the need for prudent financial management and strategic planning.

This newsletter provides an updated analysis of key economic indicators, comparing the March 2025 forecasts to those from December 2024. Commentary is provided to highlight the implications of these changes, supported by visual data and insights from the FocusEconomics reports.

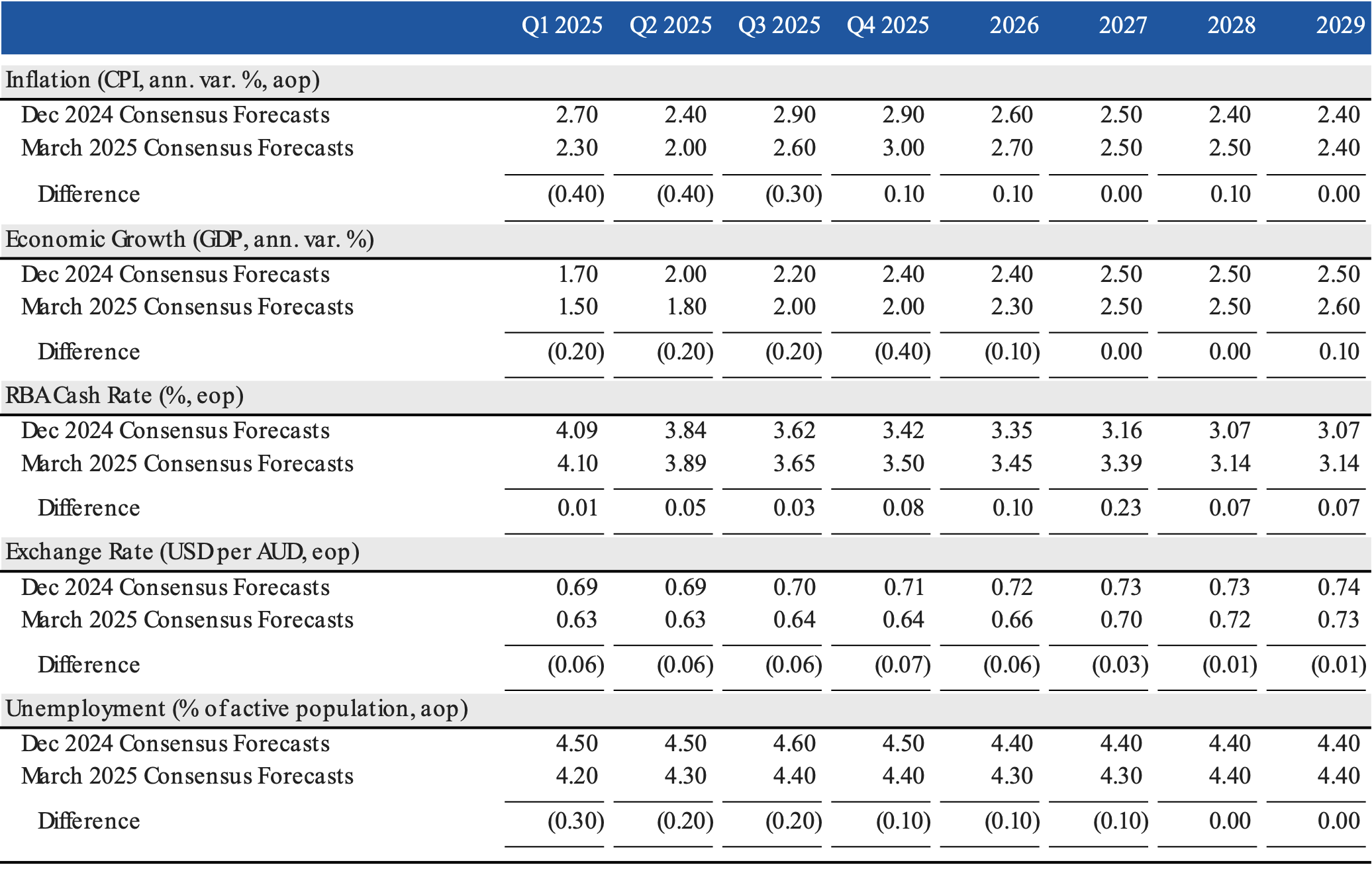

Below is a comparison of the December 2024 and March 2025 consensus forecasts for key economic indicators, along with the differences between the two periods:

Commentary on Key Indicators

Inflation (CPI, annual variation)

- Short-Term Revisions (2024–2025): Inflation forecasts for Q1 to Q3 2025 have been revised downward by 0.40% and 0.3% respectively, reflecting weaker price pressures due to easing commodity prices and subdued domestic demand. However, a modest upward adjustments for Q4 2025 (+0.10%) is observed.

- Medium-Term Stability (2026–2029): Inflation forecasts for 2026 and 2028 have been revised upward by 0.10%, while projections for 2027 and 2029 remain unchanged. Consensus forecasts reflect stabilisation within the RBA’s target range of 2.0–3.0%.

Economic Growth (GDP, annual variation)

- Short-Term Revisions (2024–2025): GDP growth projections for Q1, Q2, and Q3 2025 have been revised downward by 0.20%, with a sharper reduction of 0.40% in Q4 2025. This reflects persistent headwinds, including subdued domestic demand and external trade risks.

- Medium-Term Stability (2026–2029): Growth forecasts for 2026–2028 remain stable, with a slight upward revision of 0.10% in 2029, reflecting expectations of gradual recovery and long-term economic stability.

RBA Cash Rate

- Short-Term Revisions (2024–2025): The RBA cash rate forecasts for all quarters of 2025 have been revised slightly upward, ranging from +0.01% in Q1 to +0.08% in Q4.

- Medium-Term Stability (2026–2029): Modest upward adjustments are evident for 2026 (+0.10%) and 2027 (+0.23%), while projections for 2028 and 2029 are slightly higher.

Exchange Rate (USD per AUD)

- Short-Term Revisions (2024–2025): The Australian dollar has been revised downward for all quarters of 2025, with reductions of 0.06–0.07. This reflects weaker commodity prices, narrowing interest rate differentials with the U.S. and global trade uncertainties.

- Medium-Term Stability (2026–2029): Exchange rate forecasts for 2026–2029 show smaller downward revisions of 0.01–0.06, suggesting stabilisation in the medium-term.

Unemployment

- Short-Term Revisions (2024–2025): Unemployment forecasts have improved, with reductions of 0.30% in Q1 2025 and smaller adjustments in subsequent quarters. This reflects resilience in the labour market, supported by robust migration and population growth.

- Medium-Term Stability (2026–2029): Unemployment projections for 2026–2029 remain stable.

Conclusion

The March 2025 forecasts reflect a mixed economic outlook for Australia. While inflation and interest rates are expected to stabilise, weaker GDP growth and external risks, such as U.S. tariffs and global trade tensions, remain challenges.

Businesses should adopt a cautious approach, focusing on resilience and leveraging opportunities in sectors less exposed to external shocks. Strategic planning and proactive risk management will be critical in navigating these uncertain times.

Disclaimer

This document is provided for informational purposes only and does not constitute professional advice. The economic forecasts and analyses presented are based on consensus data from FocusEconomics. These projections are subject to change and uncertainty.

The information contained herein has been obtained from sources believed to be reliable, but Market Line makes no representations or warranties as to its accuracy, completeness, or suitability for any particular purpose. Any reliance you place on such information is strictly at your own risk.

The economic projections and opinions expressed in this newsletter are general in nature and do not take into account the specific circumstances, financial situation, or particular needs of any individual or entity. They should not be construed as recommendations to make any investment decisions or to take any specific actions.

Market Line and its employees shall not be liable for any loss or damage, direct or indirect, arising from the use of or reliance upon any information contained in this newsletter.

© 2025 Market Line Pty Ltd (ACN 644 883 483) is Corporate Authorised Representative Number 1284459 of AFSL 3442034