Executive Summary

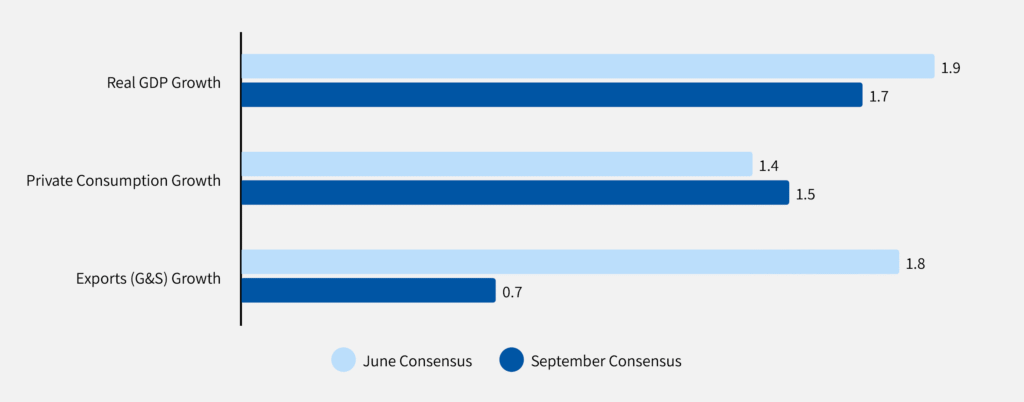

This quarter’s consensus economic forecasts reveal a divergence for Australian businesses. While the domestic operating environment remains stable, the outlook for the external sector has deteriorated sharply. The consensus forecast for 2025 export growth has been more than halved, from 1.8% to just 0.7%. This external shock, driven by rising protectionism and slowing Chinese demand, now poses the most significant threat to revenue growth for trade-exposed companies.

For valuation, the key implication is a bifurcation of risk. While domestic-focused firms can continue to concentrate on operational efficiency in a slow-growth environment, boards of export-oriented businesses must now question whether their standard cost of capital adequately captures these heightened geopolitical risks. Furthermore, while the Reserve Bank of Australia (RBA) is expected to continue its easing cycle, long-term government bond yields remain stubbornly high, preventing a meaningful reduction in the overall weighted average cost of capital (WACC) that underpins all major investment decisions and corporate valuations.

Domain 1: The Cost of Capital – The Foundation of Value

This quarter’s forecasts point to a growing disconnect between near-term monetary policy and the long-term cost of capital, a crucial dynamic for capital allocation decisions.

The Shift (What):

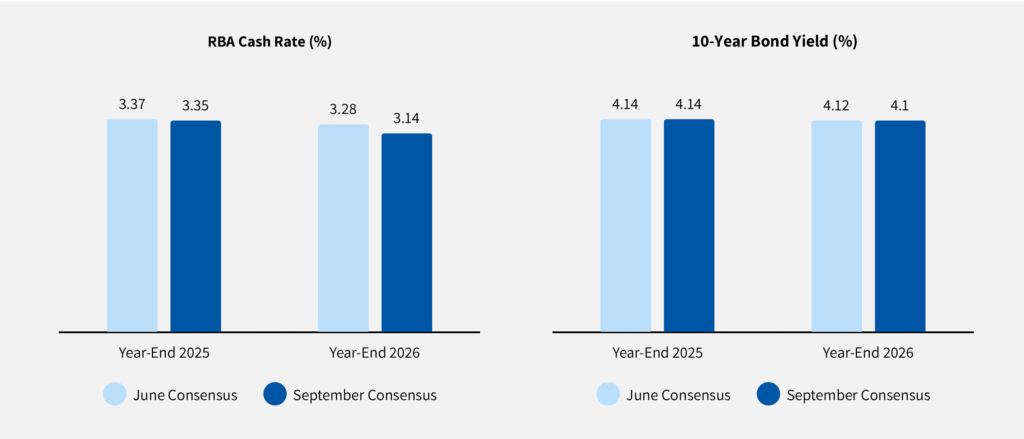

The consensus forecast for the RBA Cash Rate at the end of 2026 has been revised down by 14 basis points to 3.14%. However, the forecast for the 10-Year Government Bond Yield—the proxy for the long-term risk-free rate—has remained virtually unchanged for the same period, sitting at 4.10%.

The Valuation Impact (So What):

This signals a steepening of the yield curve and presents a challenge for WACC calculations. While the cost of short-term, floating-rate debt may decrease slightly more than anticipated, the long-term risk-free rate, which is the foundational component of the cost of equity via the Capital Asset Pricing Model (CAPM), remains elevated. This dynamic compresses the benefit of monetary easing for overall capital costs, putting persistent upward pressure on the WACC for long-duration assets and projects. Boards must be cautious not to conflate lower cash rates with a cheaper long-term cost of capital.

Domain 2: The Operating Environment & Cash Flows – The Engine of Value

The domestic economic picture is one of surprising stability, shifting the focus from macroeconomic tailwinds to company-specific execution.

The Shift (What):

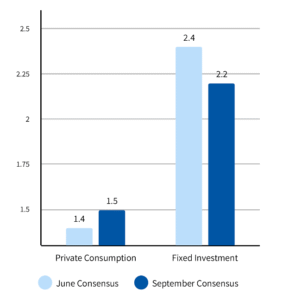

Forecasts for the core domestic drivers in 2025 are largely unchanged quarter-on-quarter. The consensus for Private Consumption saw a marginal upgrade from 1.4% to 1.5% , offset by a minor downgrade in Fixed Investment from 2.4% to 2.2%. Critically, forecasts for average annual Unemployment (4.2%) and Inflation (2.5%) are identical to last quarter.

The Valuation Impact (So What):

This stability removes macroeconomic volatility as an excuse for poor performance. With the economy tracking as expected, value creation hinges on operational excellence and disciplined capital allocation.

- Top-Line Growth: Achieving revenue growth above the low single digits will require demonstrable market share gains rather than relying on a buoyant consumer.

- Operating Margins: Stable inflation and unemployment suggest that both wage pressures and consumer pricing power are contained. Margin expansion will therefore depend on internal efficiencies, not favourable external conditions.

- Capital Investment: With investment growth slowing, the hurdle for new capital expenditure is high. A continued focus on projects where the expected Return on Invested Capital (ROIC) comfortably exceeds the WACC is paramount for value accretion.

Domain 3: The External Sector – Global Risks & Opportunities

The external sector is the epicentre of this quarter’s forecast revisions, with a significant souring of expectations for global trade.

The Shift (What):

The consensus forecast for real growth in Exports of Goods and Services in 2025 has been slashed from 1.8% to just 0.7%. This is the most material shift in this quarter’s data. Concurrently, the forecast for Imports was revised down from 2.0% to 1.2%, reflecting softer domestic demand. The AUD/USD exchange rate is forecast to end 2025 slightly stronger at $0.66, primarily due to broad-based USD softness rather than domestic economic strength.

The Valuation Impact (So What):

This sharp downgrade in export potential directly reduces the expected future cash flows for trade-exposed sectors, particularly mining and agriculture. For valuation purposes, this introduces a level of uncertainty that may not be fully captured by a company’s historical market Beta. Boards of companies with high foreign revenue exposure should consider whether a specific risk premium (an Alpha adjustment) is warranted in their valuation models to reflect the heightened risks from global protectionism and slowing demand from key partners like China.

Domain 4: Terminal Value – The Long-Term Horizon

The long-term anchors that shape the Terminal Value calculation—a critical component of any valuation—remain stable, but the underlying tension between them is a key strategic consideration.

The Shift (What):

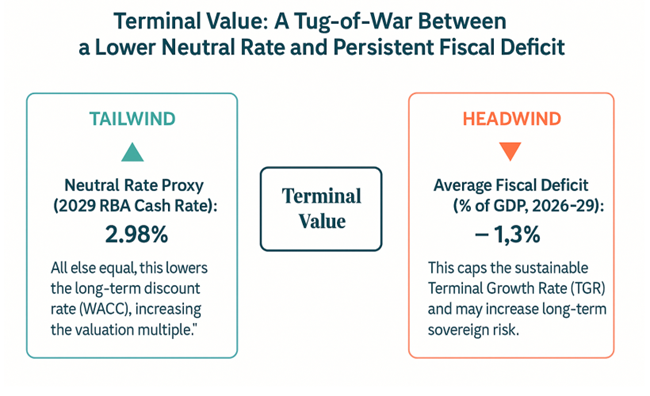

The long-term outlook is unchanged. The market’s proxy for the “neutral” RBA Cash Rate in 2029 remains at 2.98%. The long-term forecast for the Fiscal Balance also shows a consistent trajectory of modest deficits, averaging approximately -1.25% of GDP from 2026 to 2029.

The Valuation Impact (So What):

These stable long-term anchors create a persistent “tug-of-war” on the Terminal Value calculation.

- Supporting Value: A neutral rate structurally below 3% supports a lower long-term risk-free rate assumption. This, in turn, increases the terminal valuation multiple (1/(WACC−g)), providing a powerful uplift to the valuation.

- Constraining Value: The persistent fiscal deficit acts as a natural cap on the sustainable Terminal Growth Rate (TGR). It is fundamentally challenging to justify a high long-term growth assumption for the private sector when the public sector is a consistent net detractor from national savings. Therefore, while the valuation multiple may be higher, the growth rate it is applied to remains constrained..

Boards must critically assess which of these forces will have a greater impact on their business over the long-term when sanctioning valuations and long-range strategic plans.

Disclaimer

This document is provided for informational purposes only and does not constitute professional advice. The economic forecasts and analyses presented are based on consensus data from FocusEconomics. These projections are subject to change and uncertainty.

The information contained herein has been obtained from sources believed to be reliable, but Market Line makes no representations or warranties as to its accuracy, completeness, or suitability for any particular purpose. Any reliance you place on such information is strictly at your own risk.

The economic projections and opinions expressed in this newsletter are general in nature and do not take into account the specific circumstances, financial situation, or particular needs of any individual or entity. They should not be construed as recommendations to make any investment decisions or to take any specific actions.

Market Line and its employees shall not be liable for any loss or damage, direct or indirect, arising from the use of or reliance upon any information contained in this newsletter.

© 2025 Market Line Pty Ltd (ACN 644 883 483) is Corporate Authorised Representative Number 1284459 of AFSL 3442034